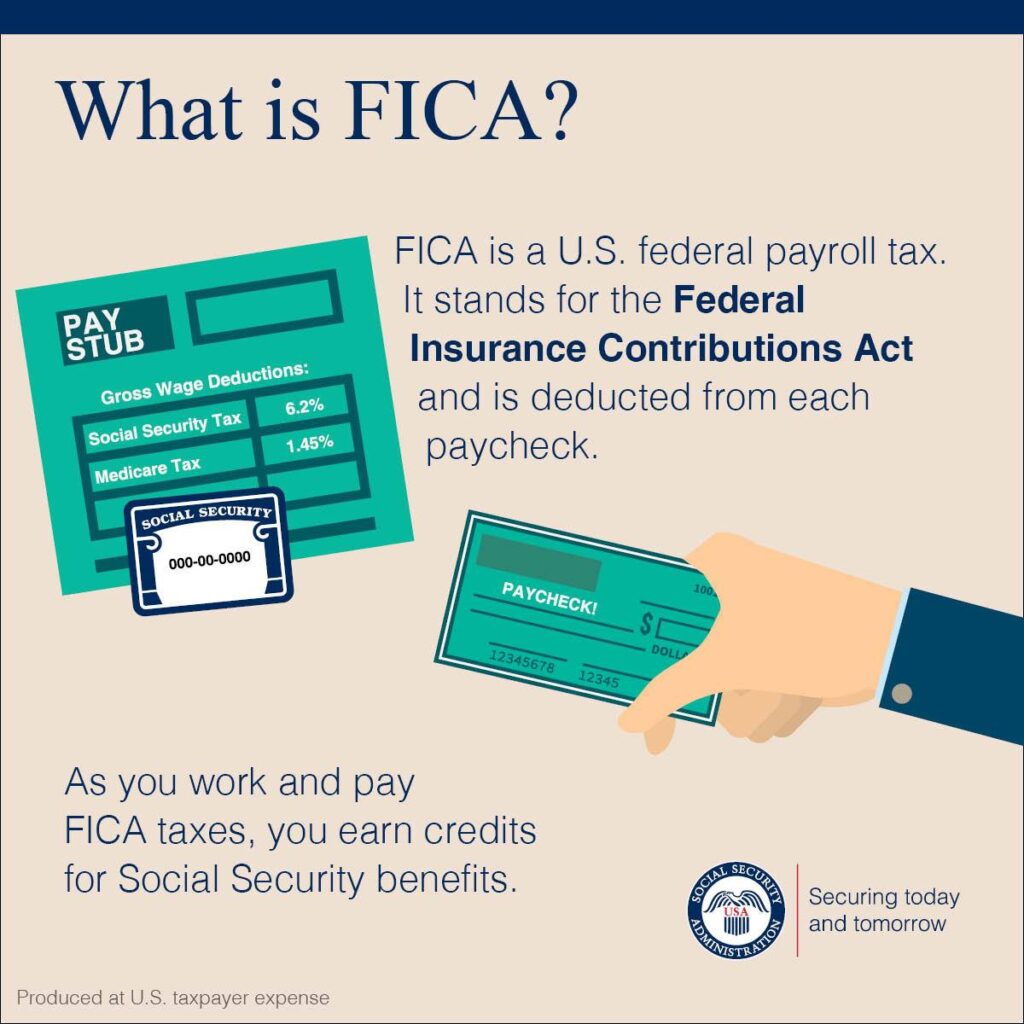

If you’ve ever checked your paycheck and wondered about “What is FICA on My Paycheck” deduction, you’re not alone. This mysterious acronym often leaves employees puzzled about where their hard-earned money is going. FICA, or Federal Insurance Contributions Act, is a critical payroll tax that supports essential programs like Social Security and Medicare. In this comprehensive, SEO-optimized guide, we’ll explain everything you need to know about FICA taxes in a clear, engaging way. From what FICA stands for to how it impacts your paycheck, we’ve got you covered with practical insights to help you understand your deductions and their purpose.

What is FICA Tax?

FICA tax is a mandatory payroll deduction in the United States that funds Social Security and Medicare, two cornerstone programs that provide financial and healthcare support for millions. Whether you’re a full-time employee, part-time worker, or self-employed, you’re likely contributing to FICA with every paycheck. This tax ensures that retirees, disabled individuals, and seniors have access to vital benefits.

For 2025, the FICA tax rate for employees is 7.65% of their wages, split into:

- 6.2% for Social Security (up to a wage cap of $168,600).

- 1.45% for Medicare (with no wage cap).

Employers match this contribution, effectively doubling the total amount paid into these programs. For high earners, an additional 0.9% Medicare tax may apply on income exceeding certain thresholds ($200,000 for individuals, $250,000 for married couples filing jointly). Understanding FICA tax helps you decode your paycheck and recognize its role in supporting social welfare.

What Does FICA Stand For?

When we talking about “What is FICA on My Paycheck” 1st we should know about what is FICA stands for Federal Insurance Contributions Act, a law passed in 1935 to establish a safety net for Americans. The “contributions” refer to the taxes withheld from your paycheck (and matched by your employer) to fund Social Security and Medicare. These programs provide:

- Social Security: Income for retirees, disabled workers, and survivors of deceased workers.

- Medicare: Healthcare coverage for individuals aged 65 and older, as well as some younger people with disabilities.

When you think What is FICA on My Paycheck, it’s a reminder that you’re contributing to these essential systems. Knowing what FICA stands for clarifies why this deduction exists and how it benefits both you and society in the long run.

What is FICA OASDI?

The term “FICA OASDI” refers to the Social Security component of FICA taxes. OASDI stands for Old-Age, Survivors, and Disability Insurance, the official name of the Social Security program. This portion of your FICA deduction supports:

- Old-Age Benefits: Monthly payments for retirees, typically starting at age 62, based on their work history.

- Survivors Benefits: Financial support for spouses, children, or dependents of deceased workers.

- Disability Insurance: Income for workers who become disabled and can no longer earn a living.

In 2025, the OASDI tax rate is 6.2% on wages up to $168,600, known as the taxable wage base. Once your income exceeds this limit, the Social Security portion of FICA stops for the year, though Medicare contributions continue. Seeing “OASDI” on your paycheck highlights the specific allocation of your FICA tax toward Social Security benefits.

What Are FICA Taxes Used For?

When we talk about What is FICA on My Paycheck, we have to aware with what are FICA taxes used for – FICA taxes are the financial foundation for Social Security and Medicare, two programs that millions of Americans rely on. Here’s how your contributions are used:

Social Security (OASDI)

The Social Security portion of FICA funds a range of benefits, including:

- Retirement Payments: Provides income for retirees based on their lifetime earnings. In 2025, the average monthly benefit is around $1,920, adjusted for inflation.

- Disability Support: Assists workers who become disabled due to medical conditions, with eligibility based on work credits and health criteria.

- Survivor Benefits: Supports families of deceased workers, such as widows, widowers, and dependent children.

- Supplemental Security Income (SSI): While primarily funded by general taxes, Social Security indirectly supports this program for low-income elderly or disabled individuals.

In 2024, Social Security distributed over $1.4 trillion to more than 70 million beneficiaries, showcasing its widespread impact.

Medicare

The Medicare portion of FICA taxes funds healthcare services, including:

- Hospital Insurance (Part A): Covers inpatient hospital stays, hospice care, and some skilled nursing services.

- Medical Insurance (Part B): Pays for doctor visits, outpatient care, and preventive services.

- Prescription Drug Coverage (Part D): Helps with medication costs for eligible beneficiaries.

Medicare serves approximately 67 million people in 2025, with costs projected to surpass $1 trillion annually. Your FICA contributions ensure that seniors and disabled individuals have access to affordable healthcare.

By funding these programs, FICA taxes create a safety net that supports Americans during retirement, disability, or medical emergencies. Hopefully now you have a clear picture about “What is FICA on My Paycheck”

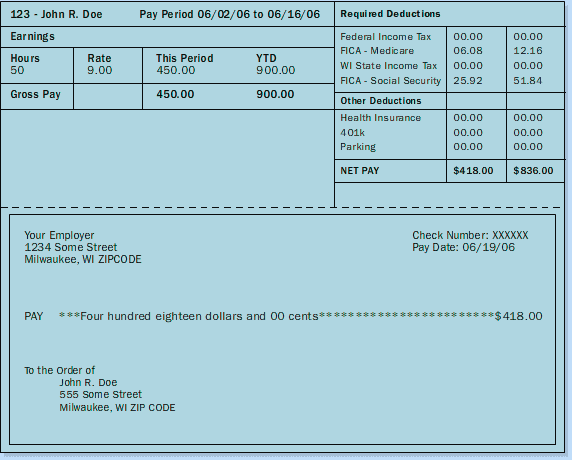

What is FICA on My Paycheck?

The “FICA” line on your paycheck represents the combined Social Security and Medicare taxes withheld from your earnings. It’s a standard deduction alongside federal and state income taxes. Here’s how it breaks down:

- Employee Contribution: You pay 7.65% of your gross wages (6.2% for Social Security, 1.45% for Medicare). For example, on a $2,500 paycheck, your FICA deduction would be $191.25 ($155 for Social Security, $36.25 for Medicare).

- Employer Contribution: Your employer matches your 7.65% contribution, paying an additional $191.25 in the above example, for a total of $382.50 per paycheck.

- Additional Medicare Tax: If your income exceeds $200,000 (or $250,000 for married couples), you pay an extra 0.9% Medicare tax, increasing your total Medicare rate to 2.35%.

- Self-Employed Workers: If you’re self-employed, you pay the full 15.3% (employee + employer portions) as the Self-Employment Tax, but you can deduct half of this amount on your income tax return.

Understanding the FICA deduction helps you budget effectively and appreciate its role in funding social programs that you may benefit from in the future.

Key Insights for Managing FICA Taxes

Why FICA Matters

FICA taxes reduce your take-home pay, but they’re an investment in your future. Your Social Security contributions determine your retirement or disability benefits, calculated based on your highest 35 years of earnings. Medicare contributions ensure access to healthcare when you’re 65 or older, minimizing medical expenses.

Frequently Asked Questions

- Can I avoid paying FICA taxes? Most workers must pay FICA, but exemptions exist for certain groups, like some government employees or religious workers with approved waivers.

- Why does Social Security tax stop at a certain income? The Social Security tax applies only up to the wage base limit ($168,600 in 2025), as benefits are capped for high earners.

- How does FICA work for self-employed individuals? Self-employed workers pay the full 15.3% but can deduct half as a business expense, reducing their taxable income.

Financial Planning Tips

Plan for High Earnings: If you’re a high earner, account for the Additional Medicare Tax in your tax planning.

Budget for FICA: Factor in the 7.65% deduction when calculating your net income.

Estimate Future Benefits: Use the Social Security Administration’s online tools to project your retirement benefits based on your contributions.

How FICA Taxes Are Calculated

Let’s break down a sample calculation for 2025:

- Annual Salary: $75,000

- Social Security Tax (6.2%): $75,000 × 0.062 = $4,650

- Medicare Tax (1.45%): $75,000 × 0.0145 = $1,087.50

- Total FICA Tax: $4,650 + $1,087.50 = $5,737.50

- Per Paycheck (Biweekly, 26 pay periods): $5,737.50 ÷ 26 = ~$220.67

Your employer matches this amount, contributing another $5,737.50. If your income exceeds $168,600, your Social Security tax stops, but Medicare contributions continue on all earnings.

FICA Updates for 2025

FICA rules evolve with economic changes. For 2025:

- The Social Security wage base limit is $168,600, up from $160,200 in 2024, reflecting inflation adjustments.

- Social Security benefits received a 2.5% cost-of-living adjustment (COLA), boosting payments for retirees.

- Medicare premiums may increase slightly, aligning with rising healthcare costs.

Staying updated on these changes helps you anticipate deductions and plan for future benefits.

Empowering Yourself with FICA Knowledge

Understanding FICA taxes transforms a confusing paycheck deduction into a meaningful contribution. By funding Social Security and Medicare, you’re securing your financial and healthcare future while supporting millions of Americans. Whether you’re early in your career or approaching retirement, knowing how FICA works empowers you to make informed financial decisions.

Next time if you think “What is FICA on My Paycheck”, you’ll understand its purpose and value. For personalized insights, visit the Social Security Administration’s website or consult your employer’s HR team. Take charge of your finances by staying informed about FICA and its impact on your life.

Conclusion

FICA taxes are a vital part of your paycheck, supporting Social Security and Medicare programs that benefit you and others. By understanding what FICA is, how it’s calculated, and what it funds, you gain clarity on your deductions and their broader impact. This knowledge not only helps you budget better but also prepares you for a secure future. Stay curious, check your pay stub, and explore how your contributions shape the social safety net! So we hope now you get What is FICA on your Paycheck.

For more such blogs and detail info stay tuned with Usamainland.com